For yacht crew stationed at Port Vauban in Antibes, days off are rare but precious. Having a curated itinerary can help you make the most of every minute when the opportunity arises. Antibes, a jewel of the French Riviera, offers an ideal blend of culture, cuisine, and coastal beauty perfect for crew members looking to unwind, explore, and experience the essence of southern France.

Morning Adventures: Antibes' Markets and Museums

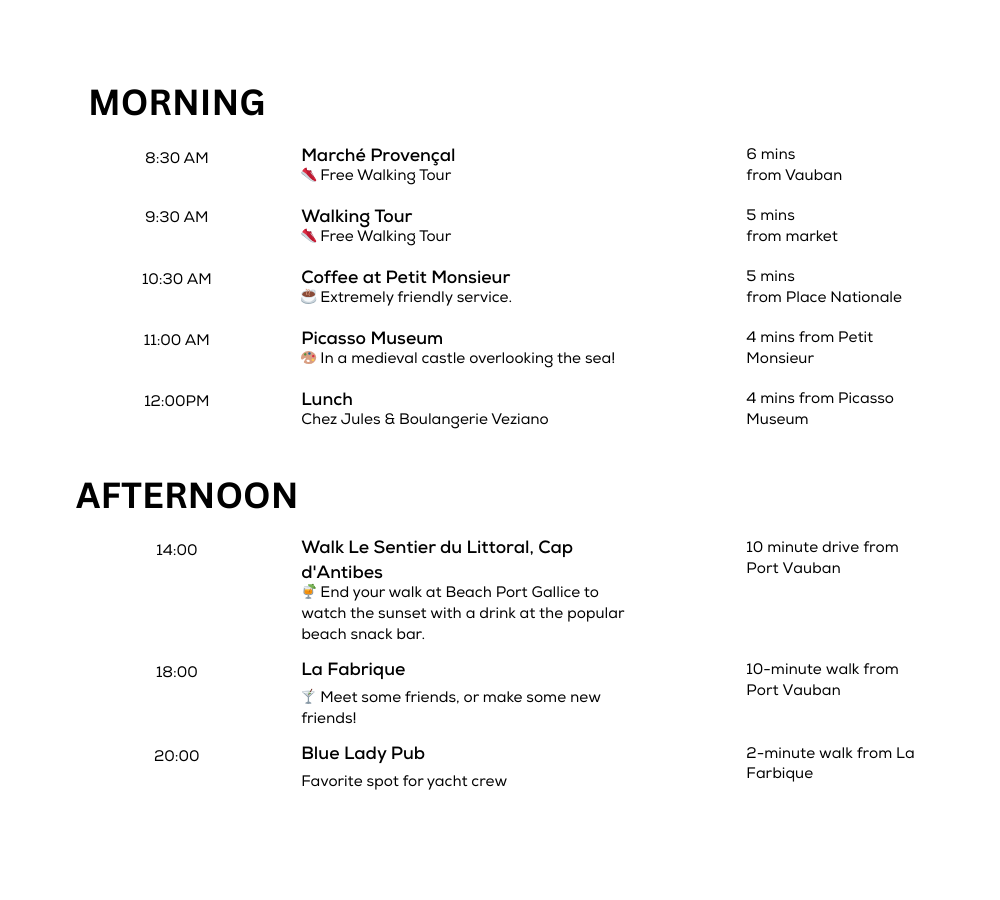

Start with Marché Provençal

Cours Masséna, 06600 Antibes

🚶 6-minute walk from Port Vauban

Your perfect day off begins at Marché Provençal, a bustling open-air market offering fresh produce, cheeses, cured meats, and handcrafted goods. It's a vibrant showcase of Provence's rich agricultural traditions. According to France's National Institute of Statistics and Economic Studies (INSEE), local markets like these play a vital role in sustaining regional economies and preserving cultural heritage (INSEE, 2023).

Free Walking Tour of Antibes

Typically meets near Place Nationale or Port Vauban.

🚶 5-minute walk from the market

Post-market, join a free walking tour to explore Antibes' history and charm. These tours provide context to the winding cobblestone streets, historic ramparts, and stories of famous residents like Picasso and F. Scott Fitzgerald. As of 2023, the French Ministry of Culture reported a surge in cultural tourism, with walking tours being one of the most popular activities for visitors to historic towns (Ministry of Culture, 2023).

Coffee at Petit Monsieur ☕

25 Rue de Fersen, 06600 Antibes

🚶 5-minute walk from Place Nationale

Open 8:00 am to 5:00 pm, Closed Tuesday & Wednesday

“Extremely friendly service.” Guillaume Lange, Managing Director in Antibes

A favorite spot of mine! Recharge with expertly-brewed coffee at Petit Monsieur, a charming spot with a cozy atmosphere and welcoming staff. It is the perfect mid-morning pick-me-up before diving deeper into the town's offerings.

Picasso Museum (Musée Picasso) 🖼️

Château Grimaldi, Place Mariejol, 06600 Antibes

🚶 4-minute walk from Petit Monsieur

No visit to Antibes is complete without the Picasso Museum. Situated in a medieval castle overlooking the sea, the museum boasts an impressive collection of Picasso's works created during his time in Antibes. The museum attracts art enthusiasts worldwide, contributing to the 8 million international tourists who visited the Provence-Alpes-Côte d'Azur region in 2023 (Atout France, 2024).

Click image to view larger

🍽️ Midday Meals: Where to Lunch in Antibes

Lunch at Chez Jules

10 Rue Thuret, 06600 Antibes

🚶 4-minute walk from Picasso Museum

For lunch, head to Chez Jules, known for its delightful French cuisine and classic bistro feel. This popular restaurant is perfect for enjoying a leisurely meal in a friendly setting.

Sweet Treats and Strolls in Antibes

Boulangerie Veziano 2 Rue de la Pompe, 06600 Antibes

🚶 3-minute walk from Chez Jules

After lunch, indulge in a pastry from Boulangerie Veziano, a beloved bakery renowned for traditional French bread and desserts.

Late Afternoon: Embracing Antibes' Coastal Beauty

Walk Le Sentier du Littoral, Cap d'Antibes

The trail starts near Plage de la Garoupe

🚙 10-minute drive or approximately 🚶 50-minute walk from Port Vauban

Wrap up your afternoon with a walk along Le Sentier du Littoral at Cap d'Antibes. This picturesque coastal path offers stunning views of the Mediterranean, secret coves, and lush greenery. End your walk at Beach Port Gallice to watch the sunset with a drink at the popular beach snack bar. This spot is a favorite among crew members, often gathering here to play frisbee and enjoy the evening atmosphere.

Evening Drinks: Social Spots for Crew

La Fabrique

1 Bd d'Aguillon, 06600 Antibes

🚶 10-minute walk from Port Vauban

Happy Hours 6-8 pm

Start your evening with a drink at La Fabrique, a vibrant bar known for craft cocktails, rosé, and beers. With its friendly owners and inviting outdoor seating, it's an easy place to start conversations and meet new people.

Blue Lady Pub

Rue Lacan, 06600 Antibes

🚶 2-minute walk from La Fabrique

Just a few steps from La Fabrique, the Blue Lady Pub is a well-known favorite among yacht crew. Its lively atmosphere and late hours make it the perfect spot to wrap up your day in Antibes.

Dessert to Close the Night

Gelateria Del Porto - Glacier Jean-Marc

4 Rue Aubernon, 06600 Antibes

🚶 5-minute walk from Blue Lady Pub

Before calling it a night, satisfy your sweet tooth with ice cream from Gelateria Del Porto. With a wide range of flavors crafted with quality ingredients, it's the perfect way to end a day full of exploration and indulgence.

Why Making the Most of Your Time Off Matters

Yacht crew members often work long hours with few days off, making it essential to maximize free time for rest and rejuvenation. Taking a break to explore destinations like Antibes enhances well-being and provides cultural enrichment.

MHG Insurance understands the unique needs of yacht crew, including the importance of comprehensive insurance coverage extending to time off. Whether exploring the French Riviera or heading home for vacation, MHG provides tailored insurance solutions that protect you on land and at sea.

About MHG Insurance

MHG Insurance is a leading insurance brokerage providing expert advice and customized solutions for seafarers, businesses, and individuals worldwide. From competitive yacht crew insurance plans to employee benefits for groups, MHG is committed to safeguarding your journey.

For more information, visit MHG Insurance.

📚 Sources

- France National Institute of Statistics and Economic Studies. (2023). "Role of Local Markets in Regional Economies." Retrieved from: insee.fr

- Ministry of Culture. (2023). "Cultural Tourism Trends." Retrieved from: culture.gouv.fr

- Atout France. (2024). "Tourism in Provence-Alpes-Côte d'Azur: Visitor Statistics and Trends." Retrieved from: atout-france.fr